← Back to Newsletter Archives

March 2024 – Volume 28 Issue 1

What is a budget and why is it important to have one? In simple terms, a budget is a written plan to decide how money will be spent, and a budget helps ensure you do not run out of money. For school districts, a budget is very important as there is only so much funding received to cover all the expenses from supplies to salaries and beyond, in addition to tracking where all the money is spent.

To help manage a tight budget, the budget figures must be entered into the School Accounting System, so that financial reports can be easily generated to show exactly what remains of the budget. A budget can be entered into the Budgets option in General Ledger using one of four methods (normal data entry, grid entry, copying a previous year’s budget or actual figures (with or without percentages), or importing); the various methods are covered in detail in the Budgets webinar (click here to request the recording). Then after the budget is posted, as expenses are paid and cash receipts are entered to record the revenue, financial reports reflect the current budget amounts remaining. The financial reports that can be generated to view the budget balances include the Revenue Summary Report, Account Inquiry reports, and custom flexible financial reports, such as an Expenditure Report by Function or an Expenditure Report by Object.

There are additional steps that can be taken to have more precise tracking of budget balances from within the School Accounting System. The additional items include:

- Entering purchase orders within the School Accounting System to have encumbrances from purchase orders reflected in General Ledger earlier in the Accounts Payable process. The outstanding purchase order amounts can then be included on the financial reports to view the unencumbered budget balances.

- Entering requisitions in the School Accounting System (via Web Link) to be able to view outstanding requisition amounts for expenditure accounts.

- Calculating a payroll purchase order to post encumbrances to the salary and benefit expense accounts for the remaining contract balances and selected payroll batches. Typically, a payroll purchase order is calculated and updated before printing the financial reports from General Ledger each month. For more information, refer to the Payroll Purchase Order topic in the Help File, or click here to request the Payroll Purchase Order Webinar recording.

Utilizing the Budgets option in the School Accounting System, and taking the additional steps as noted above, can make the task of monitoring the budget easier and more efficient.

Newsletter Survey

On the topic of budgets: Do you currently enter budget figures into the School Accounting System? If so, which method do you use to enter the budget? If not, do you plan to enter the budget in the future?

On the topic of budgets: Do you currently enter budget figures into the School Accounting System? If so, which method do you use to enter the budget? If not, do you plan to enter the budget in the future?

Click the Survey Question link to participate in the survey.

Please be sure to submit your response. We look forward to your participation in all our surveys.

Previous Survey Results

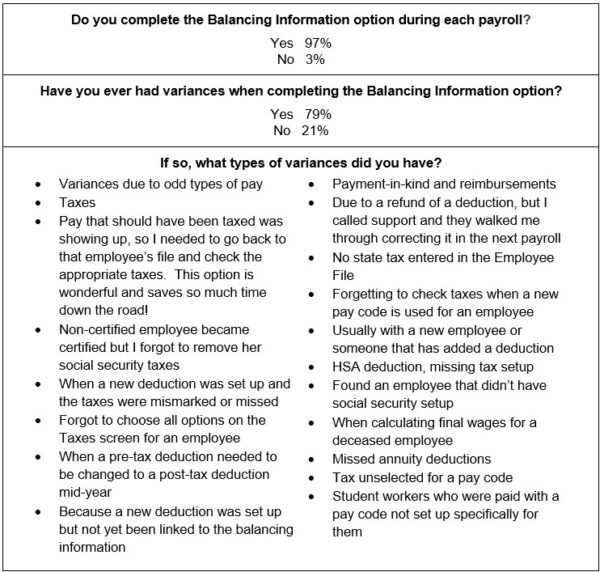

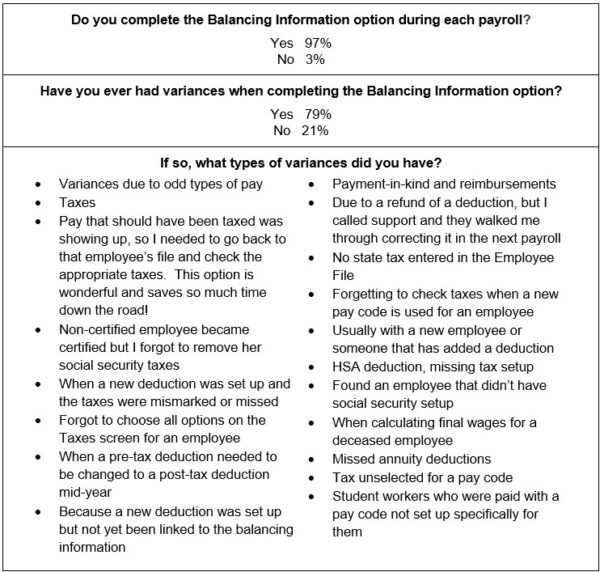

The Newsletter Survey questions for the December 2023 issue related to the Balancing Information option. The survey questions and responses are shown below.

Thanks to everyone who participated in our survey!

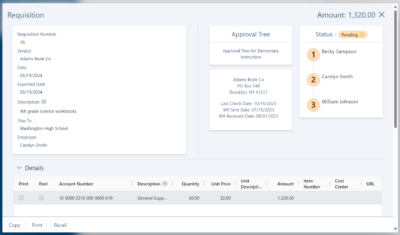

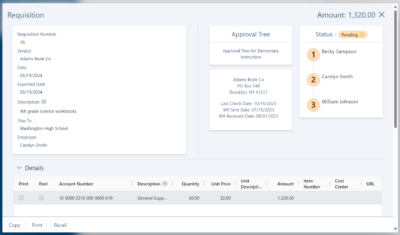

Web Link Upgrade Progress - Requisitions

In our December 2023 newsletter, we announced the commencement of the development of the next generation of the School Accounting System. We are overhauling the business layer (query logic), which will marry to an all-new, fully browser-based experience. The new web UI will offer a modern, intuitive, and responsive user experience, accessible from anywhere, anytime, and on most devices.

Our initial focus is to migrate the current capabilities of the Web Link add-on module, beginning with the Requisitions feature. We will be sending an invitation soon for organizations to opt into the ‘beta’ version of the Requisition workflow in the new user experience. The beta opt-in will allow us to collect real-time user feedback to fine-tune the user interface.

Should your organization decide to participate in the beta testing, each end user will also have the freedom to choose if they would like to try the updated requisition workflow. While the new interface will boast a modern and intuitive design, the fundamental elements of data entry and approvals will remain similar, facilitating a smooth transition for end-users.

Please keep an eye on your inbox in the coming weeks for further details and an invitation to join the beta testing phase.

K12Docs Enhancements

For organizations who have licensed K12Docs, there was a recent update that included several exciting enhancements and changes. A few of the new features include:

- Ability to now sort the columns in the search results on the main screen, or in the list of documents in a subfolder on the portfolio screen, in ascending or descending order by clicking directly on a column heading.

- A Transfer option to move misfiled documents from within K12Docs.

- The Save E-Sign button added to the top of the preview screen.

- The Find feature added to the portfolio screen in order to search for documents with certain attributes.

- The Search button added to the portfolio screen in order to search for documents within the folder based on bookmarks, notes, create time, create user, virtual file title, attributes, or fulltext.

- The Previous Folder and Next Folder buttons added to the portfolio screen to navigate to other folders.

To learn more about all the changes included in the recent update, click here to view the K12Docs Update Tutorial, or click here to access and review the release notes for the latest K12Docs update.

Kansas Sales Tax for Activity Funds

In a recent update for the School Accounting System, the ability to set up and calculate sales tax for activity funds was added for Kansas organizations. In order to set up and calculate sales tax for activity funds when entering cash receipts, complete the steps on the Sales Tax Setup Checklist for Kansas Activity Fund. The steps on the checklist include verifying (and adding, if needed) sales tax revenue accounts in the Chart of Accounts; completing the Sales Tax Revenue Account field in the Fund File for activity funds; defining sales taxes with rates in the Sales Tax File; and then utilizing the Subject to Sales Tax and Sales Tax ID fields when entering cash receipts if a detail line is for an activity fund and needs to have sales tax calculated.

The system calculates the sales tax amounts when the batch of cash receipts is posted, and additional entries for the sales taxes post in addition to the normal cash receipt entries. For example, if a cash receipt was entered for $300 earned from a fund raiser for the golf team (Golf Team Revenue account number of 72 1790 530), using a sales tax rate of 6%, the normal cash receipt entries that would post are:

$300 Debit to 72 101 – Cash

$300 Credit to 72 1790 530 – Golf Team Revenue

And then the additional entries that would post for the sales tax* are:

$16.98 Debit to 72 1790 530 – Golf Team Revenue

$16.98 Credit to 72 1930 – Sales Tax Revenue

*Sales tax is $16.98, which is 6% of $283.02, and $16.98 + $283.02 = $300

Note: If the sales tax was defined with rates split between state and local sales tax (for example, split between state sales tax of 5% and local sales tax of 1%, for a total of 6%), then the entries would include the breakdown in the amount of sales tax for state and local, as shown below:

Normal Cash Receipt Entries:

$300 Debit to 72 101 – Cash

$300 Credit to 72 1790 530 – Golf Team Revenue

Additional Sales Tax** Entries:

$14.15 Debit to 72 1790 530 – Golf Team Revenue

$3 Debit to 72 1790 530 – Golf Team Revenue

$14.15 Credit to 72 1930 – Sales Tax Revenue

$3 Credit to 72 1930 – Sales Tax Revenue

**State sales tax is $14.15, which is 5% of $283.02, and local sales tax is $2.83, which is 1% of $283.02, and $14.15 (state sales tax) + $2.83 (local sales tax) + $283.02 = $300

For detailed instructions, refer to the Sales Tax Setup Checklist for Kansas Activity Fund topic in the Help File, or click here to watch the Kansas Sales Tax Process for Activity Funds Tutorial.

Support Corner - Amy Feit, Director of Customer Support

Release Notes for the School Accounting System

In the ever-evolving landscape of technology, staying updated is not just an option but a necessity. The School Accounting System (SAS) continues to evolve, bringing you periodic updates to ensure that your experience is not only current but also increasingly efficient. These updates are comprehensive, covering a range of enhancements from tax changes and annual report modifications to new program features and essential bug fixes.

The significance of acquainting yourself with each update cannot be overstated. Highlighted in our release notes, these changes often have direct implications on your daily operations. Our support team frequently encounters instances where users could have leveraged unknown features to streamline their processes significantly. For example, the Adjust Posted Entries feature, introduced long ago and enhanced continually and noted repeatedly in the release notes, represents a considerable time-saving tool that many users discover only through our guidance during a support call. We relish the opportunity to introduce these features to you, yet we wish you had been benefiting from them all along. A brief review of our release notes with each update could be all it takes to uncover such valuable tools.

Also consider the Use Masks for Account Groups option, another useful feature that has gone unnoticed by some long-standing users. Introduced to make Account Groups dynamic, it allows for accounts to be automatically added to an account group, yet it remains underutilized simply because users did not realize it was an available option.

Accessing the update documentation couldn’t be easier. For users of the SAS-Online version, a prompt to view the latest release notes appears upon logging in after an update. With a simple click, you’re taken to a webpage showing the details of the recent changes. Furthermore, these documents are available at any time through the “View Latest Release Notes” option located in the Information section of both the main SAS screen and within each module.

By making a habit of exploring these updates, you unlock the full potential of SAS, ensuring that your operations are not only up-to-date but also as efficient and effective as possible.

If you have any questions regarding the changes or on how to access the update release notes, contact Customer Support by submitting a support request through SAS, calling 800.756.0035 ext. 2 or by emailing support@su-inc.com.

The 'Unlimited' in Software Unlimited, Inc.

Navigating the intricacies of software licensing can often prove challenging, but at SUI, we keep it simple. Our inclusive licensing includes unlimited software updates, unlimited workshops and webinars, and unlimited customer support at no additional cost.

The School Accounting System is customized to meet your state and federal reporting requirements, and our inclusive licensing module ensures that you will continue to receive the updates and enhancements that you expect without the unexpected expense. In recent years, we have built tools to help districts comply with the Affordable Care Act (ACA), Every Student Succeeds Act (ESSA) account coding changes, federal form electronic submissions, and various state reporting mandates. As we frequently enhance our software, we encourage you to review our release notes for the latest updates.

As the software evolves, we encourage you to continue learning how the School Accounting System and add-on modules can benefit you and your organization. We invite you to Register for any of our inclusive workshops, live webinars, or webinar recordings to help you leverage the system’s features and enhancements.

Our Customer Support team continues to focus on delivering unmatched customer support. We know many of you wear several different hats in your respective districts, and we understand the value you place on your time. You simply cannot wait hours or even days for a callback. With more than 50% of our support calls answered live, you will certainly receive the help you need when you need it.

End of Fiscal Year Trainings

As the saying goes – time flies! Once again, the end of fiscal year season is almost here. To make sure you are prepared to complete the end of fiscal year activities in the School Accounting System, we recommend registering to attend an end of fiscal year workshop, or registering for the applicable end of fiscal year webinars.

During the end of fiscal year trainings, we will review the steps that need to be completed at the end of the fiscal year in Accounts Payable, Payroll, and General Ledger. Both new and experienced users are encouraged to attend to review the steps that are completed only one time per year. To view the end of fiscal year workshops and webinars scheduled this year, click here to access the Training Calendar and register for a class today!

Training Snippets

Each quarter the Training Snippets tutorial covers topics for new options or changes included in recent updates, along with a quick tip for an option or shortcut. The Training Snippets tutorial for March 2024 includes the following topics: changes to the Email Manager and Email Options; Iowa W4 changes; report format available within the Iowa Budget Summary option; fund updates within the Iowa Budget Summary Report, Iowa Annual Report, and Iowa GASB 34 Reports; quarter dates available within the Missouri SDAC option; new generate option within Missouri GASB 68 option; a few report changes within the Payroll module; new process in Kansas to accommodate sales tax for Activity Funds; and lastly the Toggle Sidebar and Document Map buttons to see the Table of Contents when generating a report. Click here (or on the image below) to watch the 6-minute tutorial. To review all the changes and enhancements included in recent updates, click here to view the release notes.

Trivia Challenge

It is time for another Software Unlimited, Inc. Trivia Challenge. In each newsletter, we will test your knowledge by asking a question on various topics ranging from options in the School Accounting System to information about the company of Software Unlimited, Inc. If you are up to the challenge, try to answer the question and you may be eligible to win a USB flash drive.

Q. How do I access the feature to create a request for Customer Support for assistance with a question or issue? Click to answer

A winner will be selected at random from the list of correct respondents. Don’t forget to read the Trivia Challenge article in the next newsletter to see the winner and correct answer. Good luck!

In last quarter’s newsletter, the Trivia Challenge asked, Where can you request a copy of a webinar recording? The answer is from the Training Calendar on our website. By default, the recordings are listed at the bottom of the calendar after all the upcoming workshops and live webinars, and all the recordings can be easily viewed by selecting Webinar Recording in the Training Format filter. Congratulations to Alissa Baxter from Gibbon Public Schools for being selected at random from the list of correct respondents and winning a USB flash drive.

Closures

Software Unlimited, Inc. will be closed on:

March 29 for Good Friday

May 27 for Memorial Day

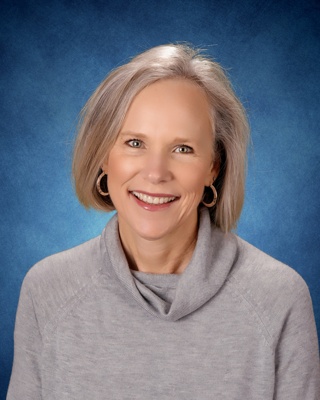

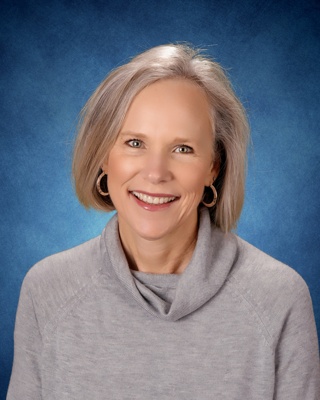

Staff Spotlight – Katie Jensen

Since 2011, I have enjoyed getting to build relationships with our customers and getting to know all of our new customers coming on board.

Outside of work, I enjoy spending time with my husband and children, Liam and Emersyn, who both turn 5 this year and start kindergarten this fall. We stay busy with their multiple activities already, and love spending time with my parents at the lake during the summer or on the farm with my husband’s family and all their cousins. We enjoy getting away to concerts and random road trips when we can.

Customer Showcase

Each quarter we are excited to feature one of our customers who was selected randomly to be highlighted in our Customer Showcase. The customer being showcased this quarter is Cathy Richardson who is the Business Manager at North Idaho STEM Charter Academy in Rathdrum, ID. We had these questions for her:

How long have you been using the School Accounting System?

• I have been using it for one year; we went live in March 2023.

What module do you spend most of your time working in?

• I spend most of my time in General Ledger.

What is your favorite feature in the School Accounting System?

• That is a tough choice as there are so many features that I really like. I do love the recurring batches in the Data Entry options. I also love how quick support is available to help. I use the Request Support feature and know I can’t leave my desk because I will hear back so quickly.

What are three words you would use to describe the School Accounting System?

• Flexible, intuitive, and excellent support.

What is your favorite part of working at your organization?

• The people that I work with and the mission of our school.

What are your hobbies?

• Biking on trails in North Idaho, and I also enjoy pickleball, golf (even though I’m not good), walking my dog, and spending time with friends.

If you could meet or interview one person (dead or alive), who would it be, and why?

• I would like to interview my grandparents on my dad’s side to find out what it was like going through the depression and raising a family during that time.

What is one piece of advice you would give someone who is new to using the School Accounting System?

• Take advantage of the recorded and live webinars; and the checklists that are available, the webinars, and the Help File are fantastic.

On the topic of budgets: Do you currently enter budget figures into the School Accounting System? If so, which method do you use to enter the budget? If not, do you plan to enter the budget in the future?

On the topic of budgets: Do you currently enter budget figures into the School Accounting System? If so, which method do you use to enter the budget? If not, do you plan to enter the budget in the future?