- Knowledge Base Categories:

- School Accounting System

- Payroll

- End of Calendar Year

Training Tidbit: How do I report the amounts on the W2 for qualified sick and family leave wages under the Families First Coronavirus Response Act?

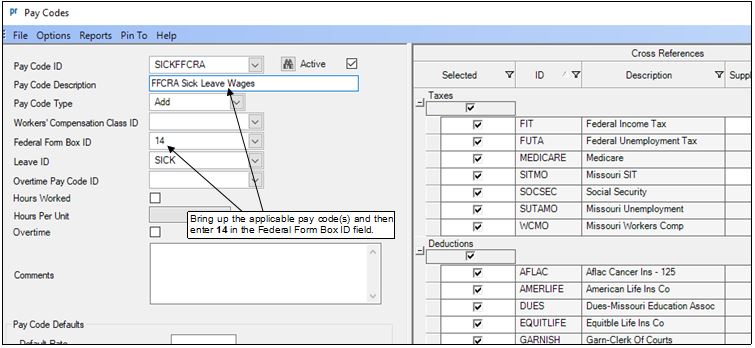

To post the amounts on the W2 for qualified sick and family leave wages paid to employees under the Families First Coronavirus Response Act (FFCRA) or the American Rescue Plan Act of 2021 (ARPA), define the applicable pay codes to post to Box 14 on the W2 by completing the following steps:

- In Payroll, select the Maintenance menu and then Pay Codes.

- Bring up the separate pay code(s) that you added for paying the qualified sick and family leave wages.

- Enter 14 in the Federal Form Box ID field, or click the down-arrow button to select Box 14.

- Click the Save button to save the changes.

By completing the Federal Form Box ID field, those wages paid for qualified sick and family leave wages under the FFCRA or ARPA will post in Box 14 on the W2 for the applicable employees. Keep in mind, the wages paid for qualified sick and family leave wages under the FFCRA or ARPA will also automatically be included in Boxes 1-6 and 16-19 on the W2, as based on the taxes selected in the Cross References List for the pay code.

For more information on setting up and paying employees for qualified sick and family leave wages under the FFCRA, click here to view the related FAQ.

Note: If the pay code had not been set up correctly (for example, a separate pay code was not defined for paying the qualified sick and family leave wages under the FFCRA or ARPA), you will need to manually calculate the appropriate amount and edit (add) the amounts in Box 14 on the W2s for the applicable employees once the W2s have been generated; for detailed instructions on editing the W2s, refer to the Editing Employee W2s topic in the Help File.